We are approaching the time of year where we invite members to renew your membership with Tennis NSW. To help you prepare for the upcoming 2024/25 Tennis NSW membership renewal period, please see below some important updates for your information.

1. Membership Renewal Timeline

Please make note of the below key membership renewal dates:

2.Membership Fees

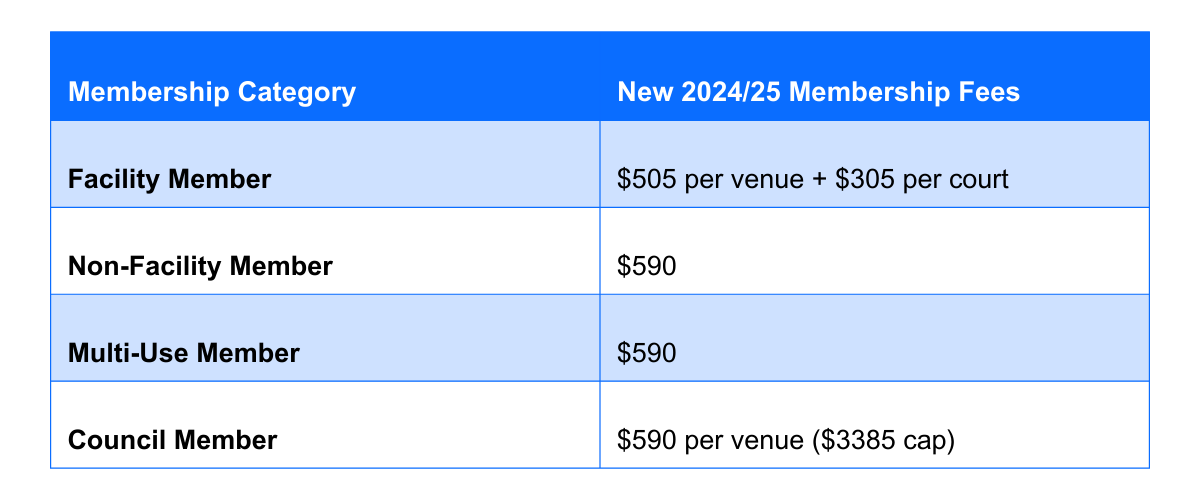

The 2024/25 membership fees will be increased in line with CPI (4.2%). This is consistent with communications sent to members in preparation for the 2023/24 membership renewal period, where prior to the financial impacts of COVID-19, a year-on-year membership fee increase aligned with CPI was common practice.

The Tennis NSW membership fees (inc. GST) for 2024/25 are:

3.Working With Children Check (WWCC) information

As has been previously communicated to you, a compulsory requirement of affiliation with Tennis NSW for the 2024/25 membership renewal period and beyond is the ability to provide evidence of your organisation’s compliance with your legal obligations relating to WWCC verification. Members must submit your completed WWCC verification register to Tennis NSW by no later than 31 August 2024.

For resources and support in meeting these requirements, including an online webinar which walks you through the steps required, please click here or email [email protected] .

4.Update on Not-for-Profit self-review return requirements (Relevant only for members who claim a Not-for-Profit tax status)

Please be aware that from the 2023/24 income year onward, Not-for-Profits (NFPs) with an active ABN will need to lodge an annual NFP self-review return in order to access income tax exemptions.

NFP’s can lodge the self-review return anytime between 1 July and 31 October 2024.

If an NFP doesn’t submit their NFP self-review return, they may become ineligible for an income tax exemption and penalties may apply.

We encourage all clubs to speak to their registered tax agents/accountants about lodging the self-review return. If any clubs prepare their own returns, they can seek guidance from the ATO on how to prepare the return. Details on how to lodge the return can be accessed here.

Thank you again for your support and we look forward to continuing to work with you over the coming year. Please do get in touch with us via email at [email protected] with any questions.