Are you looking for a safe and reliable way to send money? Chace Money Orders are a great option! They’re easy to fill out and can be used to send money across the country or even internationally. In this post, I’ll show you step-by-step how to fill out a Chase Money Order so you can send your money with confidence.

Let’s get started!

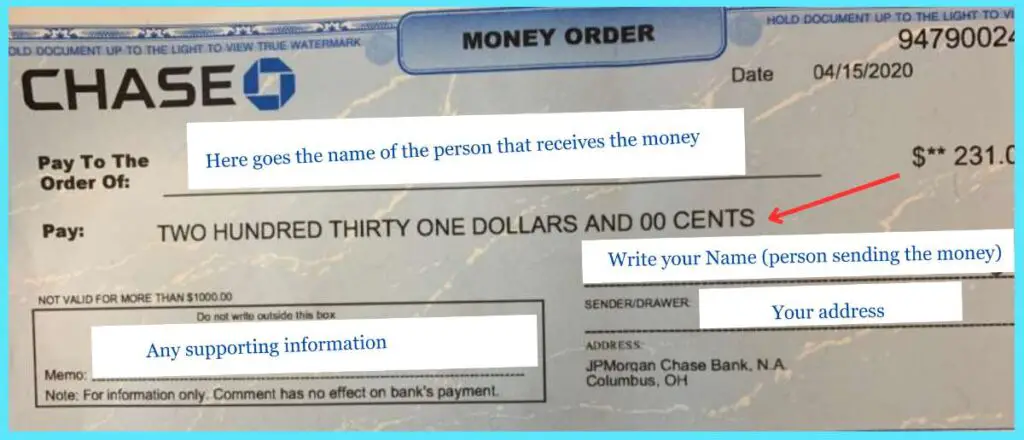

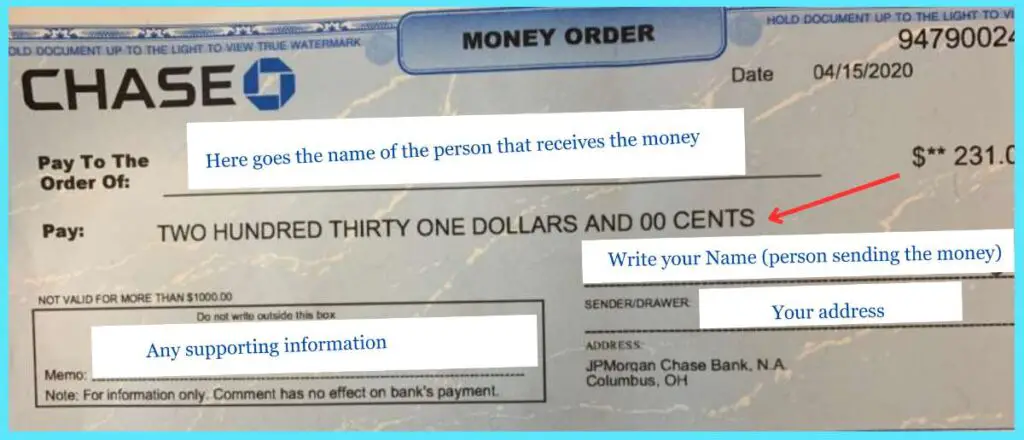

Filling out a Chase money order is a simple process that involves a few easy steps. Here is a guide on how to fill out a money order:

By following these simple steps, you can easily fill out a Chase money order and send it to your recipient.

When you purchase a Chase money order, it’s important to keep the receipt that comes with it.

The receipt serves as proof of purchase and contains important information that you may need in the future.

Here are a few reasons why retaining the receipt is essential:

The receipt is proof that you purchased the money order.

It shows the date of purchase, the amount of the money order, and the payment method used.

If you need to dispute a payment or track down a lost or stolen money order, the receipt will be your proof of purchase.

The receipt also contains a tracking number that you can use to track the money order.

This number is unique to your transaction and can be used to confirm that the money order was cashed or to track its delivery status.

If you lose the money order, the tracking number can help you locate it.

The receipt also includes a copy of the money order. This copy shows the same information that is on the original money order, including the payee’s name, the amount, and the date.

If you lose the original money order, you can use the copy to track it down or request a refund.

To ensure that you have access to the information on the receipt when you need it, it’s important to keep it in a safe place.

Consider storing it with your important documents or in a fireproof safe. If you need to access the information on the receipt, you’ll be glad you kept it safe.

In essence, your Chace Money Order receipt serves as proof of purchase, contains a tracking number, and includes a copy of the money order.

If you need to purchase a Chase money order, you can do so at any Chase Bank branch.

Chase Bank is a popular financial institution that has branches all over the United States.

You can also purchase a Chase money order online through their official website.

If you prefer to purchase a money order from a different financial institution, you can do so at various banks and credit unions.

TD Bank and Wells Fargo are examples of banks where you can purchase a money order.

In addition to banks, you can also purchase money orders at convenience stores, grocery stores, and retailers such as Walmart and supermarkets.

Western Union is another popular option for purchasing money orders.

When purchasing a money order, make sure to bring cash or a debit card.

Some issuers may also accept credit cards, but it’s best to check beforehand to avoid any issues.

You will also need to provide the recipient’s name and the amount you want to send.

It’s important to note that when purchasing a money order from a third-party issuer, there may be additional fees.

These fees can vary depending on the issuer and the amount of the money order.

Make sure to read the terms and conditions carefully before making your purchase.

If you need to send money through the mail or to someone who doesn’t have a bank account, a money order can be a good option.

Chase Bank offers money orders to its customers. Here’s how to purchase a money order from Chase:

After you have correctly filled out your Chase money order, you may need to deposit or cash a money order.

Here are some options for depositing or cashing your money order:

When depositing or cashing your money order, be sure to endorse it on the back.

This means signing your name on the back of the money order in the designated endorsement area.

If you are depositing the money order, you may also need to write your account number on the back of the money order.

It’s important to note that if your money order is lost or stolen, you may be able to get a refund or replacement.

However, you will need to have the original money order receipt and be able to provide proof of purchase.

Contact the issuer of your money order for more information on their refund and replacement policies.

Overall, depositing or cashing a money order is a straightforward process.

Just be sure to bring a valid ID and have the necessary funds to pay any fees associated with the transaction.

When filling out a Chase money order, it is essential to take certain safety measures and avoid common mistakes to ensure that your transaction goes smoothly and securely. Here are some tips to help you fill out your Chase money order safely and accurately:

These measures will ensure your Chase money order transaction is safe, accurate, and hassle-free.

When filling out a money order, it is important to follow the instructions carefully and legibly. You should provide the recipient’s name, the amount of money, and your name and address. Make sure to use a pen with black or blue ink and avoid making any mistakes or corrections. If you are unsure about how to fill out a money order, you can refer to the instructions on the money order or contact the issuer for assistance.

To fill out a Chase money order, you will need to provide the following information:

Make sure to double-check all the information before submitting the money order.

Yes, a Chase money order requires a signature from the purchaser. You should sign the money order in the purchaser’s signature section.

When filling out a Chase money order, you should make it payable to the person or business that you are giving the money order to. Make sure to write the recipient’s name clearly and accurately.

The remitter section on a money order is optional. If you want to include your name and address as the purchaser, you can fill out this section. Otherwise, you can leave it blank.

Chase money orders can be cashed at any Chase bank location. If you do not have a Chase account, you may need to provide identification and pay a fee to cash the money order. Other banks may also accept Chase money orders, but you should check with the bank first to confirm their policy.